In today’s rapidly changing financial landscape, establishing a solid financial foundation is paramount to achieving long-term stability and success. At The Great Finance, we understand the complexities of personal finance. And we are committed to guiding you towards building a strong financial future. In this comprehensive guide, we delve into key strategies and principles that will empower you to make informed decisions and navigate the intricate world of finances.

Understanding Your Financial Goals

Before embarking on any financial journey, it’s crucial to define your objectives clearly. Whether it’s saving for retirement, purchasing a home, or funding your children’s education, setting well-defined goals will provide the roadmap for your financial endeavors. Our experts work closely with you to identify your aspirations and tailor a personalized plan that aligns with your unique circumstances.

The Pillars of Financial Planning

1. Budgeting and Saving

Effective financial management starts with a meticulous budget. By tracking your income and expenses, you gain insights into your spending patterns and identify areas for potential savings. Our advisors can help you create a realistic budget that ensures you allocate funds towards both short-term needs and long-term goals.

2. Emergency Fund

Life is unpredictable, and having an emergency fund is your safety net during unexpected financial setbacks. We recommend setting aside three to six months’ worth of living expenses in a separate account, providing you with peace of mind and financial security.

3. Debt Management

Managing debt is a fundamental aspect of maintaining a strong financial foundation. Our experts analyze your existing debts, devise strategies to reduce high-interest obligations, and help you make strategic decisions about leveraging debt to achieve your goals.

Building Wealth: Investments and Assets

1. Strategic Investments

Investing wisely is integral to long-term financial growth. Our advisors assess your risk tolerance, financial objectives, and timeline to recommend diversified investment portfolios tailored to your needs. Whether it’s stocks, bonds, real estate, or mutual funds, we ensure your investments align with your aspirations.

2. Retirement Planning

Retirement may seem distant, but early planning is key to a comfortable future. We guide you through retirement account options, contribution strategies, and potential tax advantages, enabling you to build a retirement nest egg that provides the lifestyle you desire.

Safeguarding Your Legacy

1. Estate Planning

Preserving your wealth for future generations requires meticulous estate planning. Our experts collaborate with legal professionals to create a comprehensive estate plan that includes wills, trusts, and strategies to minimize estate taxes, ensuring your legacy endures according to your wishes.

2. Insurance Coverage

Insurance acts as a crucial safeguard against unexpected events. The Great Finance advisors evaluate your insurance needs, whether it’s life, health, or long-term care insurance, and design a coverage plan that shields you and your loved ones from financial hardships.

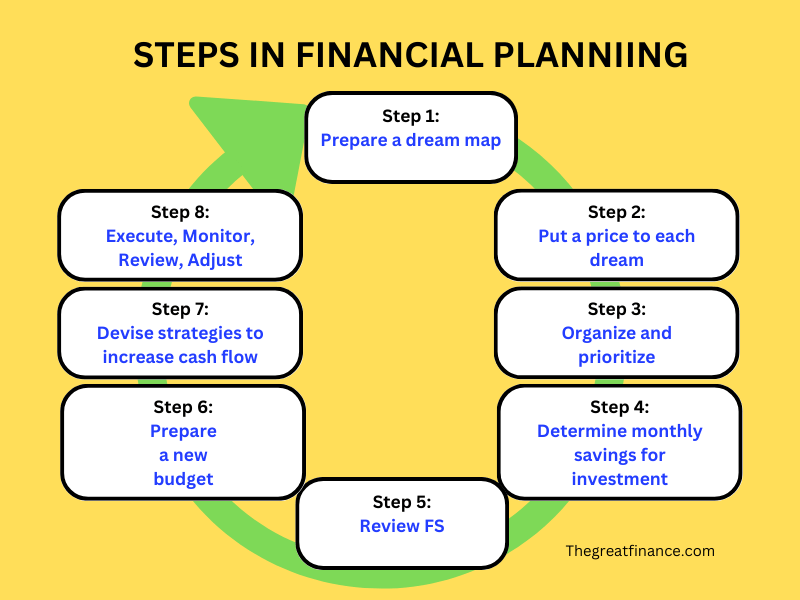

Visualizing Your Financial Journey

The diagram above depicts the stages of your financial journey, from setting goals and creating a budget to making strategic investments and securing your legacy through estate planning and insurance coverage.

Conclusion

At The Great Finance , we are dedicated to empowering you to build a robust financial foundation that stands the test of time. With our expert guidance, you can navigate the intricate landscape of personal finance, make informed decisions, and pave the way for a prosperous future. Take the first step towards financial success today by reaching out to our team of seasoned professionals. Your journey towards financial well-being starts now.