The 60 30 10 rule turns the traditional rules of budgeting on its head. Instead of focusing on your discretionary spending, this budgeting rule puts a big emphasis on sprinting towards your financial goals.

Although the 60/30/10 rule budget won’t work for everyone, many could use it to take their finances to the next level. Here’s what you need to know about the 60/30/10 rule budget.

What is the 60 30 10 rule?

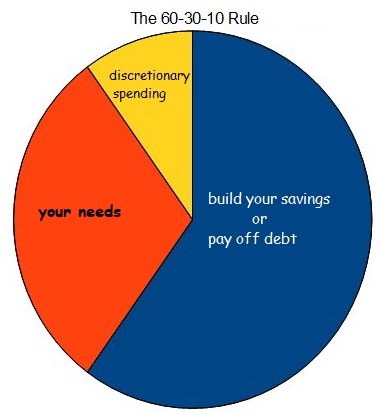

First things first, what is the 60 30 10 rule? The numbers each represent a percentage of your budget.

- With this budget, you will use 60% of your take-home pay to build your savings, invest, or pay off debt.

- Next up, you will spend 30% on your needs. These might include your food, housing, utilities, healthcare, and transportation.

- Finally, you use the remaining 10% of your budget to pay for discretionary spending. These wants might include new accessories or a spa day.

Who is the 60 30 10 rule ideal for?

After seeing the percentages, you might be curious to know who would thrive under the 60 30 10 rule budget. Ambitious savers are best suited for this budgeting style.

If you have big financial goals, then prioritizing saving might seem like the right move. For example, let’s say that you want to pay off a large amount of debt. Putting 60% of your take-home pay towards that goal will help you get there faster.

Another example is anyone interested in achieving FIRE – Financial Independence Retire Early. It is no secret that those seeking FIRE will need to save a significant amount of money.

Pros and cons of the 60 30 10 rule

As with all financial choices, there are some advantages and disadvantages to sticking with the 60/30/10 rule. Here’s a closer look at the pros and cons you should consider before diving in.

Pros of the 60 30 10 rule

Let’s kick things off with the pros of the 60/30/10 rule budget.

Faster progress to financial goals

The most obvious advantage is that you’ll accelerate your timeline for any financial goals. Whether you want to build emergency savings or pay for a big-ticket item, saving 60% of your income will help you accomplish that more quickly.

Disciplined spending on what excites you

You can still have fun with your spending. But you’ll need to be intentional and only spend on things that really matter to you. It helps to determine what your wants truly are when using the 60 30 10 rule budget.

Motivation to boost your income in creative ways

If you want to boost your discretionary spending within the 60/30/10 rule, you’ll have to increase your income. It could be the perfect way to stick to your side hustle. The budgeting rule can help you accomplish your financial goals. Plus, help you uncover what type of discretionary spending is truly important to you.

Cons of the 60 30 10 rule

Of course, there are also some downsides to keep in mind.

Limited discretionary spending options

Depending on your wants, it might be challenging to cut back on your discretionary spending. Some people prefer a more luxurious lifestyle and this budgeting method is restrictive on those types of purchases.

Adjustments to your lifestyle

You may need to cut back on the needs in your life to keep it within the 30% rule. This might include cutting back on housing or transportation costs. Also, eating at home versus dining out and finding ways to drastically cut expenses.

It is clear that you might need to make some cuts to your spending within this budget. You’ll need to decide for yourself if the cutbacks are worth it.

How do you set up a 60 30 10 rule budget

If you want to move forward with a 60/30/10 rule budget, here’s how you can set one up.

Step 1: Determine your take-home pay

The basis of the 60/30/10 budget is your take-home pay. This includes the money you earn after you account for taxes. If you are an employee, it may be as easy as looking at your paycheck to determine your take-home pay. But if you are an independent contractor or business owner, it can be more difficult to nail down your take-home pay.

The IRS offers a free tool to help you determine how much you should expect to withhold for taxes. But if you run into questions, it is a good idea to talk to a tax professional to help you determine exactly what your take-home pay is.

Step 2: Allocate to your financial goals first

Once you determine your take-home pay, it is time to allocate 60% of the funds to your financial goals. The best part is that your financial goals will be entirely unique to your situation. You may decide to build an emergency fund, start investing, or pay off debt.

Before you dive into any course of action, take some time to choose financial goals that align with your future. For example, you may want to start investing. That’s a great step! But you should consider what your long-term financial goals are to ensure you make investments that will work for you.

Step 3: Take care of your needs

Next up, you will use 30% to cover your needs. Needs encompass the essentials of life. A few examples include housing, utilities, food, transportation, and healthcare.

You may need to shop around to build a lifestyle that fits within 30% of your income. For example, you might decide to drive an older car or choose to cook at home more to save money.

Step 4: Spend the last 10% on things you want

Last but not least, the remaining 10% of funds is to spend on things that you want. Whether you want to take a lavish vacation or upgrade your wardrobe, you’ll know what your spending limits are.

Don’t be tempted to skip spending on the things you want. It is important to treat yourself to the things that matter to you. Otherwise, it can be easier to let the entire budgeting plan fall apart.

Is the 60 30 10 rule right for me?

The 60 30 10 rule is an enticing choice for anyone that wants to improve their financial situation. Before you jump in, take a minute to be realistic about your current income. If you have a lower income, this plan might be too extreme at first.

But ultimately, this budgeting strategy is possible for everyone. However, you may need to consider increasing your income through a side hustle. Or making major cuts to your spending on big-ticket items like housing and food.

Of course, there are many other types of percentage budgets that you can try first if needed to get in the groove of saving. For instance, the 70-20-10 budget, 30-30-30-10 rule, 50/30/20 budget, or the 80/20 rule are great budgets to start with.

And if these don’t suit you then you could move back to the 60 30 10 rule budget! The main thing to remember is to pay yourself first, so you are sure you save money before spending it.

Save more money with the 60 30 10 rule!

The 60 30 10 rule could help to transform your finances. You’ll significantly accelerate your progress towards long-term financial goals. But you may need to spend some time boosting your income to make this budget a comfortable reality.